Journal Entry For Repurchase Of Common Stock And Retirement

Elliott Wave Hype Is Poison For Traders

2021/12/02What Is The Difference Between Cash Cycle And Operating Cycle?

2021/12/02Journal Entry For Repurchase Of Common Stock And Retirement

Content

Amount, after allowance for credit loss, of right to consideration from customer for product sold and service rendered in normal course of business, classified as current. We accept payments via credit card, Western Union, and bank loan. Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined. Please refer to the Payment & Financial Aid page for further information. After you’ve identified your reporting date and period, you’ll need to tally your assets as of that date.

As with assets, these should be both subtotaled and then totaled together. An asset is anything a company owns which holds some amount of quantifiable value, meaning that it could be liquidated and turned to cash. You could lose money by investing in a money market mutual fund. The money market funds offered by Brex Cash are independently managed and are not affiliated with Brex Treasury. Yield is variable, fluctuates and is inclusive of reduced expense fees, as determined solely by the fund manager. See program disclosures and the applicable fund prospectus before investing for details and other information on the fund. Contact us for a copy of the fund prospectus and recent performance data.

Assets can be further broken down into current assets and non-current assets. Enjoy refreshingly easy payments, deposits, credit cards, and expense tracking— all in one place.Learn more.

The Purpose Of A Balance Sheet

Total par value equals the number of preferred stock shares outstanding times the par value per share. For example, if a company has 1 million shares of preferred stock at $25 par value per share, it reports a par value of $25 million. Firms can issue some of the capital stock over time or buy back shares that are currently owned by shareholders.

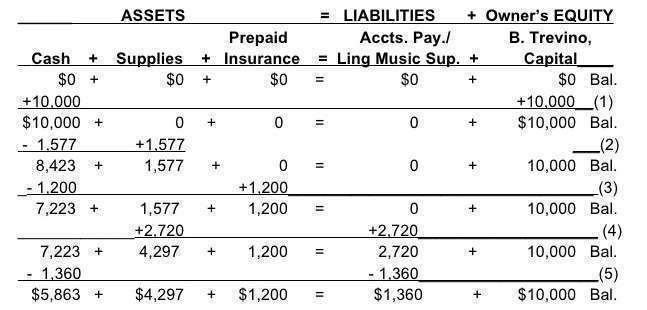

Accounting utilizes journals, which are books documenting all business transactions, and also trial balance, which is a list of all business accounts. Discover what goes into these meticulous ways of keeping records and the significance of journal entries and trial balance to accurate accounting.

Account

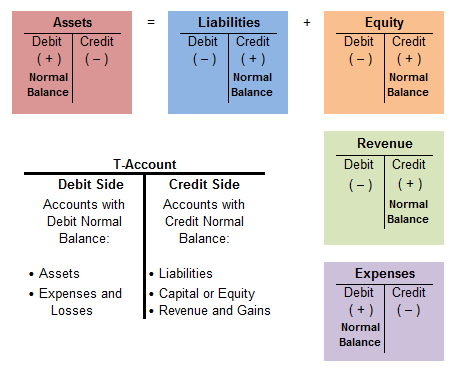

Accrual Basis Accounting is the method that produces the most helpful and accurate financial statements. A and B) Accounts Receivable and Cash are both assets and normally carry a debit balance. Debits and credits can mean either increasing or decreasing for different accounts, but their T Account representations look the same in terms of left and right positioning in relation to the “T”. Where the difference between the shares issued and the shares outstanding is equal to the number of treasury shares. Finally, the number of shares outstanding refers to shares that are owned only by outside investors, while shares owned by the issuing corporation are called treasury shares. Capital surplus is equity which cannot otherwise be classified as capital stock or retained earnings. Additional paid-in capital is the excess amount paid by an investor above the par value price of a stock during an initial public offering .

Harder to liquidate items go towards the bottom of the list. Business owners review it to track company earnings and spending. Lenders and creditors consider balance sheet data when making decisions on whether a company qualifies for bank loans or a corporate credit card.

Balance Sheet

Additionally, the supplies of the company’s shares on the market are also reduced as a result of the retirement. As mentioned, the number of shares of the common stock that the company has issued will stay the same even after it repurchases some of the shares back from the capital market. In other words, the repurchase of common stock does not reduce the number of its shares on the capital market; only retirement does it reduce the number of shares. Shareholders’ equity refers generally to the net worth of a company, and reflects the amount of money that would be left over if all assets were sold and liabilities paid. Shareholders’ equity belongs to the shareholders, whether they be private or public owners.

Is a common stock offering good or bad?

Too many investors think a secondary stock offering from a growth stock is a bad thing. In some cases, they are. … These stocks, which are usually bad investments, usually trend down (or at best sideways) before, and after, the offering because management is destroying value.

If the repurchase price is less than the original selling price, the difference increases the additional paid‐in‐capital account. Preferred stock normally is recorded at the top of the shareholders’ equity section on the balance sheet. If sales proceeds exceed the preferred stock’s par value, the surplus is recorded separately as additional paid-in capital. Bookkeepers and accountants use debits and credits to balance each recorded financial transaction for certain accounts on the company’s balance sheet and income statement. Debits and credits, used in a double-entry accounting system, allow the business to more easily balance its books at the end of each time period. Then we translate these increase or decrease effects into debits and credits.

What Is Inventory In Accounting?

The increase in shareholders’ equity also may lead to a decrease in a liability item, when either the increased equity is used to pay off a debt or a debt has been converted to equity. Likewise, the number of issued shares of common stock that the company ABC has issued so far will be reduced by 10,000 as of March 31. In this case, the treasury stock that represents the repurchased stock will also need to be removed as a result of stock retirement. As the balance of the equity increases when the company issues the common stock, repurchasing it back will logically decrease the equity on the balance sheet. However, the way of decreasing equity is not by reducing the common stock in the equity section, but by adding a contra account which is treasury stock as a result of the repurchase of common stock.

Which is better common stock or preferred stock?

Common stock tends to outperform bonds and preferred shares. It is also the type of stock that provides the biggest potential for long-term gains. If a company does well, the value of a common stock can go up. But keep in mind, if the company does poorly, the stock’s value will also go down.

Expense accounts run the gamut from advertising expenses to payroll taxes to office supplies. It’s imperative that you learn how to record correct journal entries for them because you’ll have so many. It has increased so it’s debited and cash decreased so it is credited. Knowing how to create and read a company’s balance sheet is essential to understanding the state of a business. You can generate a balance sheet for any specified period—many companies will create a multi-year balance sheet that compares how a firm has progressed over its recent history. When creating a balance sheet, the items should be listed in order by liquidity, starting with the most liquid assets, such as cash and inventory on top.

Understanding The Balance Sheet

The liability and equity accounts are on the balance sheet. In accounting, the treasury stock is recorded at cost, so the debit amount of treasury stock in the above journal entry is the total cost of the share price plus any commission (e.g. brokerage fee). Additionally, as the treasury stock is recorded at the cost of purchase, there is no par value involved like the transaction of issuing of common stock either. The company can make the journal entry for repurchase of common stock by debiting the treasury stock account and crediting the cash account.

The Progressive Corporation: Don’t Get Caught By Dividend Decrease – Seeking Alpha

The Progressive Corporation: Don’t Get Caught By Dividend Decrease.

Posted: Mon, 29 Nov 2021 14:00:00 GMT [source]

Past performance is not necessarily indicative of future results. Long-term liabilities include capital leases, deferred compensation, and bank loans with a term of more than one year. common stock normal balance The balance sheet should conclude with two columns with corresponding figures at the bottom. A. January 22, purchased, an asset, merchandise inventory on account for $2,800.

LO 3.2Cromwell Corporation has the following trial balance account balances, given in no certain order, as of December 31, 2018. Using the information provided, prepare Cromwell’s annual financial statements . This lesson will introduce you to the accounts payable process, which is an internal control system designed to assure the integrity of the recording for purchase transactions.

- A double-entry accounting system means that every transaction that a company makes is recorded in at least two accounts, where one account gets a “debit” entry while another account gets a “credit” entry.

- If the Board of Directors has not specified a stated value, the entire amount received when the shares are sold is recorded in the common stock account.

- The fund’s sponsor has no legal obligation to provide financial support to the fund and you should not expect that it will do so at any time.

- However, if large cash figures are typical of a company’s balance sheet over time, it could be a red flag that management is too shortsighted to know what to do with the money.

- Due to the existence of contra-accounts, some assets may normally have a credit balance and some liabilities may hold a debit balance and it is important to identify what sort of balance is normal.

- The other part of the entry will involve the stockholders’ equity account Retained Earnings.

The balance sheet provides a snapshot of several important factors about a business. Reviewing the statement will provide valuable financial information on the following factors. LO 3.1Identify the normal balance for each of the following accounts. LO 3.2Consider the following accounts, and determine if the account is an asset , a liability , or equity . Accountants regularly complete bank reconciliations, which is the balancing of a company’s cash account balance with a corresponding bank account balance. Learn about the definition, purpose, examples, and process of preparing bank reconciliations.

Double check that all of your entries are, in fact, correct and accurate. You may have omitted or duplicated assets, liabilities, or equity, or miscalculated your totals. You would debit notes payable because the company made a payment on the loan, so the account decreases.

ParcelPal Logistics : CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS – Form 6-K – marketscreener.com

ParcelPal Logistics : CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS – Form 6-K.

Posted: Mon, 29 Nov 2021 12:11:15 GMT [source]

Comparing debt to owner or shareholders’ equity is a common way of analyzing leverage on the balance sheet. When liabilities or debt is high, a conservative investor may be alarmed. But higher liabilities do not necessarily mean the business is in trouble—the company may be strategically leveraged. For example, a business balance sheet reports $250,000 in assets, $150,000 in liabilities, and $100,000 in owner’s equity. The creditors have a claim of $150,000 against the company’s $250,000 in assets. Once the debts are paid off, the owner can claim their equity of $100,000. The assets on the left will equal the liabilities and equity on the right.

- In issuing its common stock, a company is effectively selling a piece of itself.

- Non-current liabilities are typically those that a company doesn’t expect to repay within one year.

- However, it would make sense to obtain the previous year’s Balance Sheet to compare any trends that should be addressed in the next fiscal year.

- Therefore, the total paid-in capital is $40,000 ($4,000 par value of the shares + $36,000 amount of additional capital in excess of par).

- Review the above balance sheet example from Apple, Inc., to understand how to read a balance sheet.

Likewise, if the company producesnet incomefor the year and doesn’t distribute that money to its owner, equity increases. Amount of currency on hand as well as demand deposits with banks or financial institutions. Includes other kinds of accounts that have the general characteristics of demand deposits. Excludes cash and cash equivalents within disposal group and discontinued operation. Sum of the carrying amounts as of the balance sheet date of all assets that are recognized. If a company or organization is privately held by a single owner, then shareholders’ equity will generally be pretty straightforward. If it’s publicly held, this calculation may become more complicated depending on the various types of stock issued.

For instance, if an investor paid $10 for a $5 par value stock, $5 would be recorded as common stock and $5 would be recorded as paid-in capital. Stock purchases or partnership buy-ins are considered capital because both are comprised of cash contributions made by the owners to the company. Capital accounts have a credit balance and increase the overall equity account.

Author: Emmett Gienapp